Big Digitization of Indian Retail – Kiranas to FMCG Producers

Retail in India is growing fast and changing rapidly, in particular the groceries segment potential is vast, and everyone wants a slice of the pie.

Retail in India is growing fast and changing rapidly, in particular the groceries segment potential is vast, and everyone wants a slice of the pie.

Retail sector is seeing significant disruption with digitisation of Kiranas (family-owned shops selling groceries and other sundries), the rapid rise of ecommerce (D2C and eB2B), and private-label companies making market share gains. In addition, mega distributors such as JioMart are leveraging digital, which has impacted distributors, retailers, FMCG companies, and, ultimately, the consumer. Demographic and economic shifts in income (especially post Covid-19), along with (more…)

Titan’s Tanishq Jewellery + Taniera Stores Glitter with Wedding

Titan’s jewelry business is broadly on track even as steep inflation in gold prices and lockdown dampened full year growth.

Titan’s jewelry business is broadly on track even as steep inflation in gold prices and lockdown dampened full year growth.

Indians Love Jewelry & Royal Wedding

Tanishq wedding jewelry portfolio comprises 16 community assortments under the brand Rivaah. Over the last few, the company has augmented its wedding jewelry range to add traditional and differentiated jewelry designs to suit local preferences in each region (higher localization). Further, it has tweaked pricing to narrow pricing gap with regional competition (competitive making charges for undifferentiated products and premium in case of (more…)

Can D-Mart compete Reliance Retail after Future Group Mergers ?

The exit of Pioneer Kishore Biyani’s Future Group is indeed an industry shaping event and one that highlights that winners will be few even though the opportunity for modern retailing in India is large. Online & multichannel Retailing Growth will be captured by large-scale, efficient players that are relentlessly focussed on delivering a superior value proposition to consumer (through better prices, sharp assortments, and convenience). A country of India’s size can easily accommodate 4 to 5 large scale national players. We see this consolidation as a sign of rising barriers to entry, which is positive for Avenue Supermart’s D-Mart Hypermarket Stores.

The exit of Pioneer Kishore Biyani’s Future Group is indeed an industry shaping event and one that highlights that winners will be few even though the opportunity for modern retailing in India is large. Online & multichannel Retailing Growth will be captured by large-scale, efficient players that are relentlessly focussed on delivering a superior value proposition to consumer (through better prices, sharp assortments, and convenience). A country of India’s size can easily accommodate 4 to 5 large scale national players. We see this consolidation as a sign of rising barriers to entry, which is positive for Avenue Supermart’s D-Mart Hypermarket Stores.

Reliance Retail and Future Retail combined will be larger than DMART. Given the superior and meticulous execution skills of DMart management, it is (more…)

Why Reliance bought Future Retail in Largest Deal – Insider View

After getting series of funding into Akash Ambani run Jio Platforms, Reliance Industries CMD, Mukesh Ambani set his sight on his daughter Isha Ambani Piramal managed Reliance Retail Ventures Ltd .

After getting series of funding into Akash Ambani run Jio Platforms, Reliance Industries CMD, Mukesh Ambani set his sight on his daughter Isha Ambani Piramal managed Reliance Retail Ventures Ltd .

Talks had progressed in the backstage between the Reliance Group & Kishore Biyani’s Future Group for quite sometime. Reliance through its newly formed group company Reliance Retail Ventures Limited will acquire Future Enterprise Ltd (Future Retail, Future Lifestyle Fashions, Future Supply Chain, Future Consumer, Future Market Networks would first be merged into Future Enterprise), on a slump sale basis for an enterprise value of Rs247 bn, subject to regulatory approvals. This marks a major consolidation in the Indian organized retail sector, with two of the top three players merging.

How Reliance Retail Compares with Future Retail Ltd (FRL) ?

Reliance Retail revenue in FY20 was Rs346 bn and that of Future Retail annualized revenue of FY20 (based on 9M FY20 results) was ~Rs100 bn. Future Retail has (more…)

Why Reliance Retail acquired NetMeds Online Pharmacy ?

Reliance Retail has announced the acquisition of a 60% stake in Netmeds (Indian digital pharma market place) for US$83mn. Netmeds is present in 670 cities and towns and offers more than 70,000+ prescription and lifestyle drugs and thousands of non-prescription goods for wellness, health and personal care. Netmed promoters have a long history in pharma retailing and manufacturing. Netmeds had ~US$1mn in revenues ~(US$8mn loss) in F18. Its app also offers doctor consultation services as well.

Reliance Retail has announced the acquisition of a 60% stake in Netmeds (Indian digital pharma market place) for US$83mn. Netmeds is present in 670 cities and towns and offers more than 70,000+ prescription and lifestyle drugs and thousands of non-prescription goods for wellness, health and personal care. Netmed promoters have a long history in pharma retailing and manufacturing. Netmeds had ~US$1mn in revenues ~(US$8mn loss) in F18. Its app also offers doctor consultation services as well.

Online medicine market currently is (more…)

DMart Efficiencies help in COVID Times, e-Commerce Views

Avenue Supermart owned DMart hypermarket chain was no exception and witnessed diminishing footfalls in its stores during COVID-19 as social distancing is keeping customers away from crowded locations. It also had lower sale of general merchandise and apparel categories perhaps due to deferment of purchases. The company is trying to offset lower footfalls by keeping its stores open for longer hours (24X7 in some cases) to spread out shoppers through the day. D-Mart is also witnessing a shift in the profile of shoppers – the proportion of upper-middle income class customers has diminished more, understandably so as they are less value conscious.

Avenue Supermart owned DMart hypermarket chain was no exception and witnessed diminishing footfalls in its stores during COVID-19 as social distancing is keeping customers away from crowded locations. It also had lower sale of general merchandise and apparel categories perhaps due to deferment of purchases. The company is trying to offset lower footfalls by keeping its stores open for longer hours (24X7 in some cases) to spread out shoppers through the day. D-Mart is also witnessing a shift in the profile of shoppers – the proportion of upper-middle income class customers has diminished more, understandably so as they are less value conscious.

Dmart has not thought about the kirana digitization model. The success of this chain has been its own sourcing and supply chain operations are efficient enough to ensure low costs throughout the value chain. Large stores help the company in two ways: (1) they are more capex efficient on a per sq. ft basis, and (2) they provide a greater runway for (more…)

Pandemic & Rising Bullion impact on Jewellery Chains

Due to COVID-19 Lockdown, most of the Jewellery Stores were shut through June. In Jewelry segment, about 90% of the stores were open in July. For the leading brand, Tanishq, Retail sales in June recovered to 77% of last year’s levels followed by a strong recovery in July to 101%. Retail sales of studded jewelry stood at 59% of base month in June and 67% in July. Consumer sentiment towards gold has been fairly positive. Titan has witnessed some advancement of purchases for weddings. Rising Gold Price can (more…)

Due to COVID-19 Lockdown, most of the Jewellery Stores were shut through June. In Jewelry segment, about 90% of the stores were open in July. For the leading brand, Tanishq, Retail sales in June recovered to 77% of last year’s levels followed by a strong recovery in July to 101%. Retail sales of studded jewelry stood at 59% of base month in June and 67% in July. Consumer sentiment towards gold has been fairly positive. Titan has witnessed some advancement of purchases for weddings. Rising Gold Price can (more…)

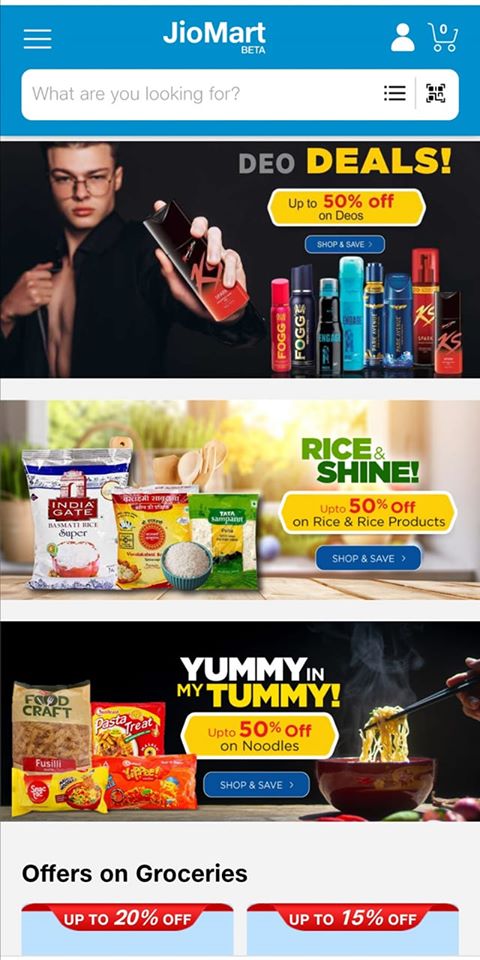

Will Mukesh Ambani Succeed in JioMart super app?

Mukesh Ambani led Reliance group is embarking on an ambitious idea to merge two of largest spending categories of Indian Consumers – Digital & Retail. JioMart is an innovative business idea in this regard. Reliance is trying to tap into the most popular communication platform (WhatsApp), enabling subscribers to order from neighborhood kirana (mom-and-pop) stores that leverage Reliance Retail’s supply-chain backend.

Mukesh Ambani led Reliance group is embarking on an ambitious idea to merge two of largest spending categories of Indian Consumers – Digital & Retail. JioMart is an innovative business idea in this regard. Reliance is trying to tap into the most popular communication platform (WhatsApp), enabling subscribers to order from neighborhood kirana (mom-and-pop) stores that leverage Reliance Retail’s supply-chain backend.

If executed well, JioMart will be able to create a strong, scalable platform with an extremely high entry barrier. However some of the issues in this Tri-Party Digital Retailing experiment are as under,

- Grocery business yields a meager 13% gross profit margin, which for this business model has to be divided between three participants: Jio, Facebook and kirana stores. Hence even with a 25% market share of online grocery segments by FY25, the available profit pool for the participants will be relatively small.

- The sheer number of intermediaries, SKUs and scale of operations create numerous fault lines.

- There are established competitors of varying size bringing in various competencies on the table.

The Big Omni-Channel Reliance Retail Setup

Reliance plans to become the largest (more…)